Note: The government announced significant delays to making tax digital in July 2017. This update should therefore be read in conjunction with our July 2017 update which is available on our website.

WHAT IS MAKING TAX DIGITAL?

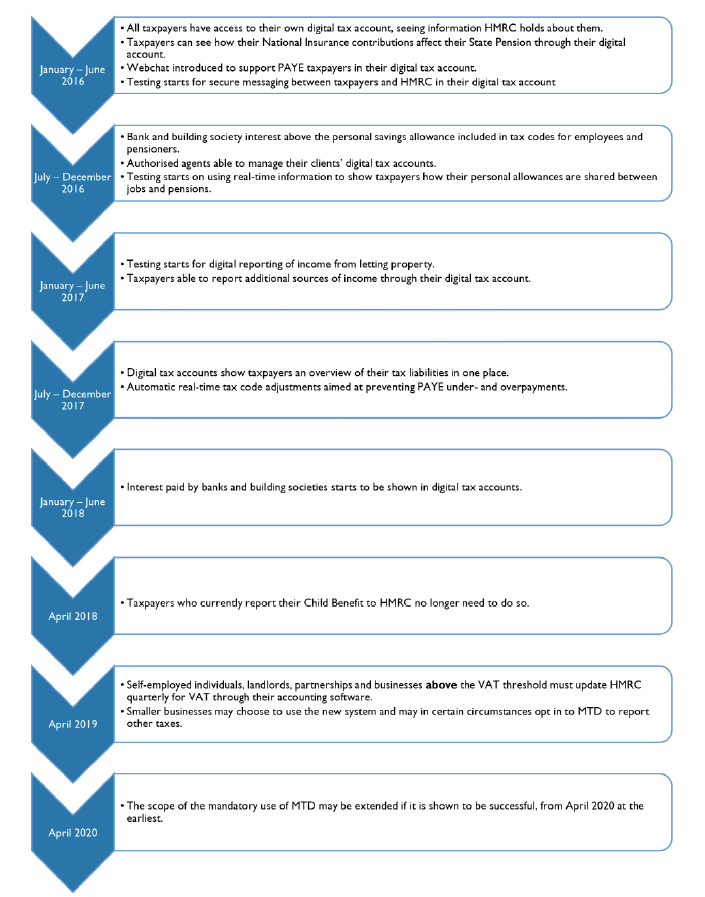

Making Tax Digital (‘MTD’) is a large-scale project currently being developed and tested by HMRC. It is intended to simplify tax reporting, as well as to facilitate the collection and storage of tax-related data. All of HMRC’s systems will be joined up, with each taxpayer having just one tax account.

There will be a quarterly filing requirement for many individuals. Users will be able to log in to their online tax account, make adjustments to their reported income and expenses and pay any tax due in instalments. Online billing will collect any tax not paid through PAYE and, in some circumstances, there will be no need for an annual Self-Assessment tax return to be filed.

THE SELF-EMPLOYED AND LANDLORDS

Those who are self-employed and/or landlords with turnover in excess of £10,000 per year will need to report their income and expenses on a quarterly basis.

For most of these taxpayers, digital record-keeping will be mandatory with the necessary record-keeping software linking direct to HMRC’s systems.

For most this will apply from April 2018 onwards, although it was recently announced that the self-employed / landlords with turnover of less than the VAT threshold will have one more year to prepare, until April 2019.

Free software will be available to enable individuals to comply with the quarterly filing requirement in the most simple cases.

A reconciliation of year-end activity will need to be submitted ten months after the end of the accounting period, or by 31 January – whichever is sooner. We expect many individuals will choose to align their accounting period with the tax year so that the year-end reporting date will tie in with the existing tax return filing deadline of 31 January.

Individuals who have both rental income and self-employment income may need to make separate quarterly submissions for each source of income. The unused personal allowance will be spread over each quarter and the amount available will take into account the various income sources. This should enable individuals to track the tax due throughout the year.

The reporting of trading income should be simplified under the new system. The cash accounting threshold will be increased to £150,000, and this is due to take effect from April 2017. There are also proposals to review the basis period rules, to reduce the number of adjustments required under UK Generally Accepted Accounting Principles and to reduce the complexities of capital versus revenue expenditure, although these proposals are still in planning stage.

PARTNERSHIPS

Partnerships will file their quarterly reports to HMRC and the relevant share of taxable profit would then appear automatically in the partner’s digital tax account, without a specific need for the individual to complete his or her own tax return.

We believe that partnerships with turnover above / below the VAT threshold will be subject to the same staging dates as the self-employed and landlords, other than for ‘large’ partnerships (turnover above £10M), where the MTD requirement is deferred until 2020.

COMPANIES

Companies will fall within the MTD framework from April 2020.

CONCLUSIONS

MTD will result in complex and far-reaching changes to how many taxpayers report to HMRC. For those individuals who currently use an agent to complete and file their tax returns the changes should have less of an impact, but affected individuals will be required to provide updated financial details to their accountant four times a year.

This is an enormous project for HMRC and, as many of you will be aware, similar IT-based projects have not gone smoothly in the past. As a result, we should plan for technical problems and believe it is prudent for all individuals to take any action required as early as possible in the staging process. Unfortunately, it is not yet clear exactly what action will be required and when it will need to be done by, and we are missing most of the key details particularly in relation to clients with complex affairs. Where our clients are affected we will open up discussion on how best to prepare for the additional filing requirements. We will also provide more general updates as and when we receive further details from HMRC.

The information contained in this document is for information only. It is not a substitute for taking professional advice. In no event will Dixon Wilson accept liability to any person for any decision made or action taken in reliance on information contained in this document or from any linked website.

This firm is not authorised under the Financial Services and Markets Act 2000 but we are able in certain circumstances to offer a limited range of investment services to clients because we are members of the Institute of Chartered Accountants in England and Wales. We can provide these investment services if they are an incidental part of the professional services we have been engaged to provide.

The services described in this document may include investment services of this kind.

Dixon Wilson

22 Chancery Lane

London

WC2A 1LS

T: +44 (0)20 7680 8100

F: +44 (0)20 7680 8101

DX: 51 LDE

www.dixonwilson.co.uk

dw@dixonwilson.co.uk