Types of Charitable Organisation

There are five main types of charity structures:

- Charitable Trust

- Unincorporated Association

- Company Limited by Guarantee

- Charitable Incorporated Organisation (CIO)

- Foundation CIO

Each of these structures has distinct properties, and a comparison table is available at the end of this page. Additionally, those interested in providing community benefits or pursuing a social enterprise may want to consider establishing a Community Interest Company (CIC). While not classified as a registered charity, CICs use their profits and assets for the benefit of the community or to engage in trading for a social purpose. Although they are not strictly "not for profit," CICs can deliver returns to investors. Typically, CICs are structured as companies limited by guarantee, although they can also be limited by shares. It is even possible for a CIC to operate as a public limited company (PLC).

For further details about CICs, please see What is a CIC - Dixon Wilson.

1. Charitable Trust

A Charitable Trust is a trust created for charitable purposes where trustees hold the assets of the charity on the terms specified in the trust. The trustees can be individuals or a company. The trust is not a separate legal entity, and it is the trustees who jointly hold the property and enter into contractual commitments. Any changes in trustees, therefore, may require transfers of assets to be appropriately documented, and trustees may require some form of indemnity.

The filing requirements are limited to those of the Charity Commission. Accounts are required only where income levels are over £25,000. When income is between £25,000 and £250,000, accounts can be prepared either on the receipts and payments basis or under accruals accounting. These accounts are also subject to external scrutiny (Independent Examination, unless the governing documents require an audit). When income is between £250,000 and £1,000,000 and the net assets do not exceed £3.26 million, accruals accounts must be prepared and be subject to external scrutiny (Independent Examination by a member of a body specified under the Charities Act, unless the governing document requires an audit). When income is over £1,000,000, or net assets exceed £3.26 million and income is over £250,000, accruals accounts are required, and so too is an audit.

An annual return is required only where income is over £10,000. Below this, confirmation of details is required. This must be filed within 10 months of the accounting period end.

There are no registers to keep or file with the Charity Commission. Discussions and decisions made between trustees are confidential, and trustees are only answerable for their conduct to the court and the Charity Commission. Depending on the drafting of the Trust Deed, alterations may only be possible by order of the court and in limited circumstances.

2. Unincorporated Association

An unincorporated association is a body such as a members’ club. These are usually set up where wider membership is required in order to meet the charity’s objectives, without the burden of Companies House filing obligations. An example of this is a sports club, structured as a charity, where members pay an annual fee.

3. Company Limited by Guarantee

A company limited by guarantee is a separate legal entity and may do several things in its own name. For example: enter into contracts, own land and property, and employ staff. The assets of the company can only be applied for charitable purposes or to support the charitable activities, and the reserves cannot be distributed to members or shareholders. The trustees of the charity are also directors for company purposes, and therefore benefit from some level of limited liability.

The company must comply with not only the filing requirements of the Charity Commission, but also with Companies House. There is no option to prepare and file receipts and payments accounts; accruals accounts must be prepared for all income levels. The requirements for external scrutiny are the same as for charitable trusts.

An annual return is required only where income is over £10,000. Below this, confirmation of details is required. This must be filed within 10 months of the accounting period end; however, the accounts for Companies House must be filed within 9 months of the year end.

As a company, there are also legal requirements to file registers and charges with Companies House. There are financial penalties for failure to comply with these corporate duties and, in the worst cases, a company may be struck off and Directors banned from current or future appointments. Alterations to the Memorandum and Articles of Association are relatively straightforward and can simply be filed online; however, prior written consent of the Charity Commission may be required if the changes relate to how the company’s property may be applied or held for charitable purposes.

To remain a charity, the company must have income over £5,000 a year. If not, then the charity will be de-registered from the Charity Commission and will simply continue as a company.

4. Association CIO

An association CIO is an incorporated organisation that is set up by constitution and is automatically registered with the Charity Commission. They do not exist before registration, and there is no minimum income requirement for registration. An association CIO may have voting members other than the trustees, and therefore has a much wider membership compared to a foundation CIO.

The CIO needs only to comply with the filing requirements of the Charity Commission; it is not registered with Companies House. The filing threshold requirements are the same as for a charitable trust; however, accounts must be prepared even where income is less than £25,000.

An annual return is required each year. This must be filed within 10 months of the accounting period end.

Decisions can be made by consensus rather than by calling general meetings. This can also be carried out by email. There is also no requirement to keep a register of charges, which can make borrowing harder, although businesses are gradually becoming more familiar with the CIO structure.

5. Foundation CIO

A foundation CIO is as above; however, the only members are the trustees. This structure, therefore, has closed membership, which gives greater control over the activities of the CIO, as the number of members is smaller.

Conclusions

Charitable trusts are appropriate where the charity will be administered by a small number of people and will not enter into significant contractual commitments, for example, a grant-making body.

Charitable companies are an appropriate structure when an organisation is expected to control substantial assets, to employ a large number of staff, or to engage in charitable activities inevitably involving risks of a commercial nature, which result in financial liabilities.

CIOs provide a unique crossover between the trusts and the companies. They provide the protection of a company and create a separate legal entity which can own substantial assets and enter into commercial transactions, whilst also providing a simpler administrative burden. Unlike Charitable Companies, however, CIOs are not required to file accounts and reports with Companies House, therefore reducing the administrative burden and associated filing costs.

The main difference between a Company and a CIO will be in the operation of the charity: directors and companies must comply with the Companies Act 2006 in the structure and format of decision making, whereas the trustees of a CIO can make decisions and arrangements more flexibly.

Where activities are likely to be large or complex, a charitable company is likely to be preferable.

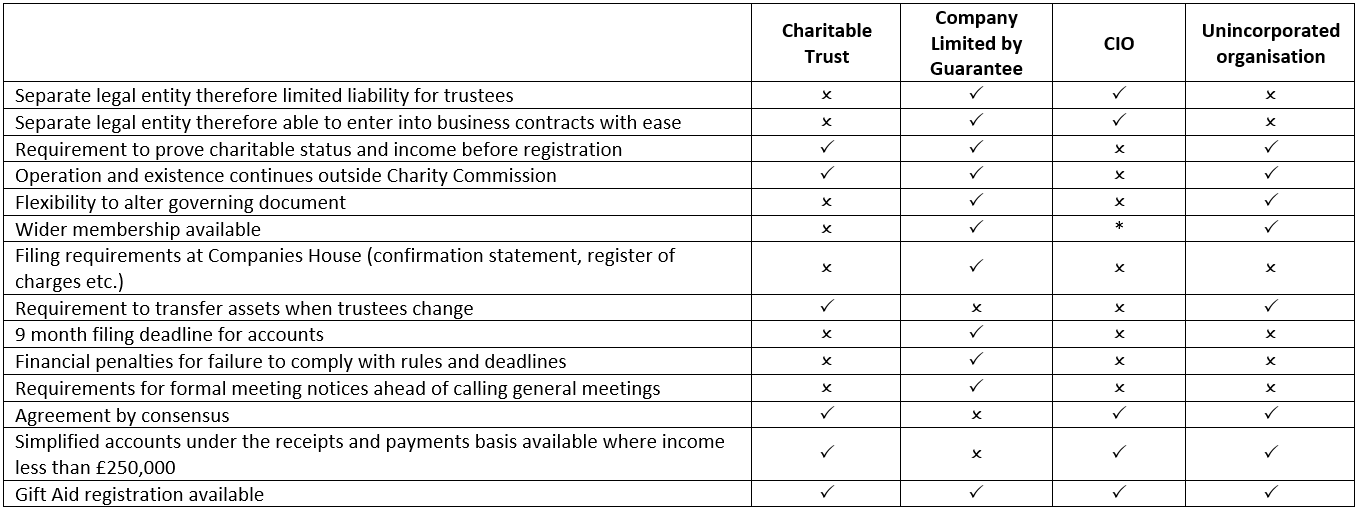

Appendix 1: Comparison Table

* Wider membership is available for Association CIOs; Foundation CIOs are closed