Introduction

Various types of partnerships may be formed under English partnership law, including general partnerships, limited liability partnerships (“LLP”) and limited partnerships (“LP”).

The general concept of partnerships is that they are transparent for UK tax purposes. However, the taxation of partnerships has seen a number of changes over the past few years with the introduction of anti-avoidance provisions designed to tackle perceived abuse. These include restrictions relating to “salaried” LLP members and “mixed” partnerships, both of which are explained below.

Income Tax And Partnerships

Partnerships are transparent for income tax purposes. This means that the individual partners are subject to tax on their share of the profits realised in the partnership. The partnership itself does not pay income or capital gains tax. However, it must still prepare and submit a tax return which details the taxable profits of the partnership and how those profits are split between the partners.

Non-resident partners are only subject to UK tax on UK-source investment income and profits generated by the partnership, and separate calculations should be prepared on the non-resident basis for partners who are resident overseas, where relevant.

Similarly, any partnerships that have a corporate partner should prepare separate calculations according to corporation tax rules rather than income and capital gains tax rules (which will continue to apply to all individual partners).

The most common difference arising between income and corporation tax rules is the treatment of interest receivable. Under income tax rules, interest is taxed when received, whereas under corporation tax rules, interest is subject to tax in the period in which it is due to be received, irrespective of the date of receipt. This is known as the ‘accruals’ basis.

Where a partnership carries on a trade, the profits of the trade are included in each UK tax year according to the ‘basis period’ rules, which usually follow the partnership’s accounting year-end.

Non-trading income, for example property rental income, is usually reported on the partnership tax return for the tax year of receipt (i.e. to each 5th April).

Management expenses arising in an investment partnership are generally disallowed under income tax rules but allowed under corporation tax rules.

Losses

In most cases, trade losses can be set against a partner’s other taxable income (known as “sideways” loss relief). Restrictions on sideways loss relief can apply to:

- Members of an LLP;

- Limited partners; and

- Non-active partners in both general partnerships and LLPs. A non-active partner for these purposes is one who spends less than 10 hours per week on average on the activities of the trading partnership.

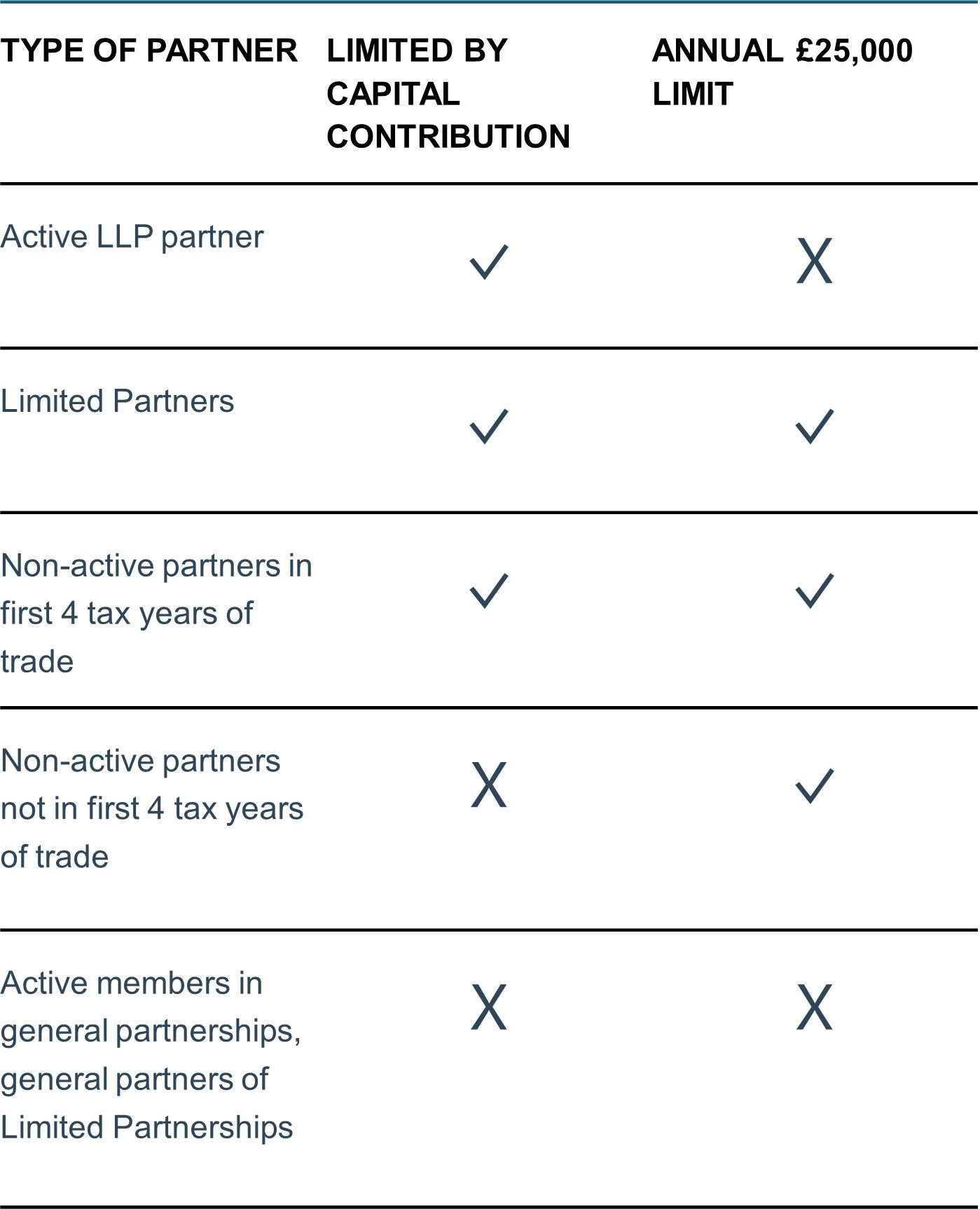

For active members of an LLP the sideways loss relief is restricted to the member’s capital contributions to the LLP at the end of that tax year, less the total of all sideways loss relief previously claimed by the member with respect to losses from the same trade.

For limited partners and non-active partners in the first four tax years of trade, losses are restricted to the lower of:

- £25,000 per year; and

- The partner’s capital contributions at the end of the basis period for the relevant tax year, less any relief previously claimed.

For non-active partners not in the first four tax years of trading, losses are restricted to an annual cap of £25,000.

The restriction on sideways loss relief is summarised as follows:

All taxpayers are also subject to a general restriction on loss relief, which limits the potential claim for relief to the greater of £50,000 or 25% of the individual’s adjusted total income for the year.

Farmers and market gardeners are subject to further restrictions on losses.

It is worth noting that any partnership or sole trade must be carried out on a commercial basis with a view to the realisation of profits in order for sideways loss relief to be available.

Where losses are not available to be sideways relieved, they will usually be carried forward to offset against the first available future profits from the same trade.

SALARIED MEMBER RULES

The salaried member rules apply only to LLPs (not to general partnerships). Under the rules, an individual member is taxed as an employee of the LLP if they satisfy (all) three conditions:

A. It is reasonable to expect that at least 80% of the amount payable to the LLP member is ‘disguised salary’, defined as amounts which are fixed, or which are variable but not with reference to the overall profits or losses of the LLP; B. The member does not have significant influence over the affairs of the LLP; and C. The member’s capital contribution to the LLP is less than 25% of the disguised salary as defined under A. For these purposes, undrawn profits that have not been added to LLP capital are not taken into account.

If all three conditions are satisfied, the individual member is treated as an employee of the LLP with the member’s income from the LLP then being taxed through PAYE. It is important to note that the salaried member is only considered an employee for tax purposes, but not when looking at employment rights granted to ‘normal’ employees (such as statutory sick pay, holiday pay, etc.).

MIXED PARTNERSHIPS RULES

The mixed partnership rules apply where partners include both individuals and non-individuals, which could include trusts but usually means companies. For ease of reference, this note uses corporate members to signify all non-individual members.

For the provisions to apply, the partnership must realise a profit and that profit must be allocated either fully to the corporate member or split between individual partners and corporate members. The partnership must then satisfy one of two conditions:

1. It is reasonable to assume that the corporate member’s share of profit comprises amounts representing deferred profits of the individual partner(s) and, as a result, the profit share for the individual(s) is reduced, as is the overall tax bill; or 2. The second condition is made up of four components, all of which must be met: a. The corporate member’s profit share must exceed the ‘appropriate notional profit’; b. The individual partner(s) must have the power to ‘enjoy’ the profit share attributed to the corporate member; c. It must be reasonable to suppose that the whole or part of the profit allocated to the corporate member is because the individual partner(s) can ‘enjoy’ those profits; and d. The profit share(s) of the individual(s) and the overall tax charge must be lower than they would if the individual partner(s) could not ‘enjoy’ the corporate member’s profit share.

The appropriate notional profit is defined as the sum of the ‘appropriate notional return on capital’ and the ‘appropriate notional consideration for services’. The appropriate notional return on capital is the return on capital that the corporate member could reasonably expect, by reference to a commercial rate of interest.

Where either of these conditions are satisfied, the provisions require a re-allocation of the profit shares allocated to the corporate members and the individual partners. The individual partners’ profit shares are increased by the ‘excessive’ amount allocated to the corporate members, i.e. the deferred profits referred to in 1 or amounts in excess of the appropriate notional profit referred to in 2.

Capital Gains - Statement Of Practice D12 ("SP D12")

SP D12 sets out HMRC’s interpretation of the capital gains tax (“CGT”) rules applying to the disposal of individual partnership assets or the whole partnership by individual partners. It also governs the CGT treatment of partners joining or leaving the partnership and changes in partnership profit sharing ratios. This note does not consider all aspects of SP D12.

Where an asset is disposed of by a partnership to a third party, each of the partners is treated as disposing of their fractional share in the asset. CGT is then calculated in accordance with the normal rules.

Where a partnership distributes an asset out to a partner, a computation is required to calculate the gains chargeable on the individual partners as if the asset had been disposed of to a third party at its current market value. Where this results in a gain, the partners disposing of their share in the asset are subject to capital gains tax in the year of distribution. The partner receiving the asset is not subject to capital gains tax; instead, the base cost of the asset is reduced by the amount of the calculated gain.

When a partner’s fractional share changes, e.g. when a new partner joins or a partner leaves the partnership, the partners’ whose shares have decreased are treated as having disposed of an interest in the partnership’s chargeable assets, including goodwill, equal to the reduction in their fractional share. Whether a capital gain or loss arises depends on whether the assets have been revalued in the partnership accounts. If the assets are held at cost, there should be no immediate capital gains tax implications.

Entrepreneur's Relief On Disposal

An individual partner may qualify for Entrepreneurs’ Relief on the disposal of a part or the whole of a partnership business provided that the business has been owned by the partner for at least one year ending on the date of disposal.

The disposal of any assets owned by a partner personally but used in the partnership trade may also qualify for entrepreneurs’ relief provided it meets the conditions to be an “associated disposal”.

What Next?

The taxation of partnerships has seen a number of changes over the last few years, not all of which have been covered above. If you think that any of the above could affect you, please seek advice from your usual Dixon Wilson contact.

The information contained in this document is for information only. It is not a substitute for taking professional advice. In no event will Dixon Wilson accept liability to any person for any decision made or action taken in reliance on information contained in this document or from any linked website. This firm is not authorised under the Financial Services and Markets Act 2000 but we are able in certain circumstances to offer a limited range of investment services to clients because we are members of the Institute of Chartered Accountants in England and Wales. We can provide these investment services if they are an incidental part of the professional services we have been engaged to provide. The services described in this document may include investment services of this kind.